4 investors whose money we had to turn down

In a tightening venture capital landscape, startups may be tempted to accept less-than-favorable terms. Watch out: this could mean trouble for your company. Here is why, with some examples from my own experience.

This post is derived from a talk I gave to the Swiss Tech Association in Bern.

Most startups have to raise some money to fund the development of their product. The first funding rounds are most often done with business angels, who are not professional investors, just individuals with some cash on hand1.

The checks they sign may be as low as $10k—and there are lots of people with an extra $10k lying around!

This means that a BA may or may not know the typical terms for investments. They may or may not understand the field in which you are. They may not even know how to start a startup!

You could think that this would not matter. You could think that cash is cash and you don’t really care where it comes from. You would be dead wrong.

See, an investor can bring much more than just money. In the best case, a business angel may open doors, share their expertise or connect you with other investors.

In a neutral case, the business angel gives you money and then gets out of your way. That’s less valuable than the first kind, but hey, it’s still cash! That’s usually what happens when your rich aunt coughs up 20 grand for you to shut up about that internet thing you are doing.

But in the worst case, an investor can interfere with your business up to destroying it by opposing your decisions, pushing you in a wrong direction, requesting excessive documentation, and so on.

And once you’ve taken their money, there is no way for you to get rid of an investor: you can’t just give the money back (even if you have it). You’re now partners, for better or worse.

The terms investors request may help you identify bad seeds (sorry for the pun). I’ll share here some of my own experiences, and how they could have led to catastrophic outcomes for my company, Teleport, had we taken the money. Note that this list reflects my personal encounters only: it doesn’t pretend to be exhaustive nor to capture the worst terms possible. Yet, I hope this will give some sense of why all startup money is not created equal.

My worst seed stage investment terms

Let me introduce four different investors with their four set of noxious terms. I present:

The Feng Shui Guy

The No Salary Increase Guy

The Very Lean Startup Guy

The 50% Discount People

I’m not naming them, for reasons that sound less and less obvious the more I think about them. But still. Here it goes.

1. The Feng Shui Guy

The first example may sound bening, but was nothing but. We had been put in touch with the assistant of a very high net worth individual interested in investing. I spent a great deal of time speaking with the assistant, and he made a good impression: he was asking smart questions, we went into a lot of details that were important to our success, and he was dedicating a lot of energy into the deal, coming into calls late at night and so on.

For a long time I didn’t meet the individual he represented, and didn’t think much of it. He must be very busy, I thought.

Finally, just before signing, I’m invited to a call with that person. From the get-go my feeling is… not as good as with his assistant. First of all, he didn’t care one iota about what we were doing, so he clearly wouldn’t be bringing any valuable expertise. But the red flag was when he asked for my and my co-founder’s dates and places of birth.

See, he had to run that by his Feng Shui master, to determine whether the investment was a sound idea.

Now, should you hear that, the right reaction would be to bid farewell, right there and then. I wish I could say that’s what we did. Actually, we thought “whatever, that’s what billionaires do”. He ended up not investing in our company, following his Feng Shui master’s advice.

Since then I shiver to think what would have happened had we been born in a suitable place and time. What if, after investing, that person had started running our strategic decisions by the same guy? What if we had to ask our prospective business partners for their personal information, to ask our investor’s Feng Shui master? What if the Feng Shui master thought PHP was a better language to write our code?

We would have been no better off than if we were basing our decisions on rolls of dice.

2. The No Salary Increase Guy

The No Salary Increase Guy was a reasonably well-off professional, very interested by our product, who wanted to invest $25k. He was not from the field but was smart enough to understand the potential, the challenges, and so on. We had some debate about our valuation, but nothing major.

But right before signing, that person became very queasy, and started asking what exactly we intended to do with the money. At first I didn’t quite understand his question: we had presented him a detailed business plan, with financials. Everything was there!

He then asked us to add a clause that his investment would not be used for salary increases or bonuses to the founders. There we had it: he was scared that we’d simply pull the money out for our personal use.

Now that may sound like a reasonable request: no one investing in a startup does it for the founder to buy themselves a new car. However, this shone a light on the investor’s lack of understanding of our situation. I had just poured two years of my life in that company, working day and night, paying myself and my co-founders rock-bottom salaries. Did I do all of that just to lure an investor in, snatch their $25k, and put the survival of the company in jeopardy? Of course not, that would have been the dumbest thing ever! We were in it for the long run, and our ambitions were much higher.

Most importantly though, it revealed a lack of trust that no contract will ever solve. You cannot put in writing everything a startup can and cannot do: investors and founders have to trust each other.

With that in mind, we had to turn his investment down.

3. The Very Lean Startup Guy

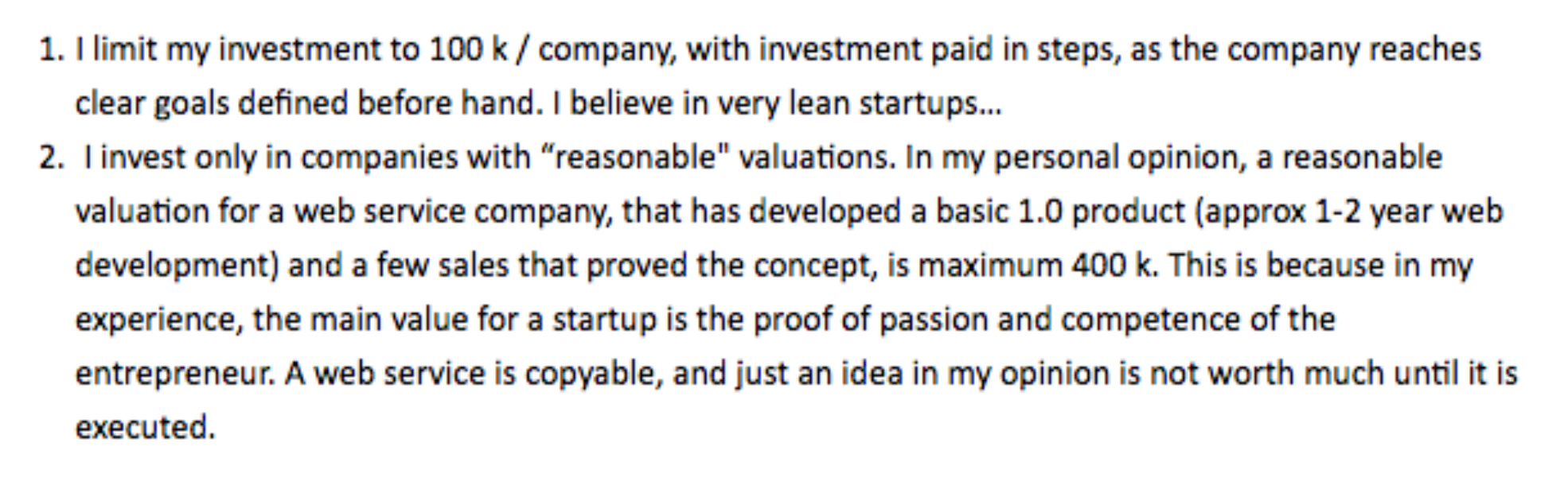

While the No Salary Increase guy wasn’t experienced with startups and investment terms, he recognized his lack of knowledge and was very nice when I told him we wouldn’t be taking his money. My number 3 however believed himself an expert. After a couple of emails, he sent me these terms:

There’s a lot to unpack here. First of all, that person wanted to take 25% of our company for a 100k investment (that’s what a 400k valuation means). At that moment, we had spent about a year and a half working on our product. It was live and we had paying customers: it was by no means “just an idea”. Now, as I’ve written in the past, it is very hard to justify a startup valuation with hard data since so much is uncertain, however we were never going to raise at $400k (we ended up raising at $2m, meaning we gave up 5% ownership for 100k and not 25%).

Getting a deflated valuation is not to the investor’s advantage either. You could imagine that they are getting more shares for their money, which should be good. However, if you’re able to rob a founder of part of their shares, you are diminishing their involvement in their company by that much, and the founder’s involvement is the single most important thing—something the Very Lean Startup guy seemed to appreciate.

But the most ludicrous part was that “the investment [will be] paid in steps, as the company reaches clear goals defined before hand”. We had a monthly burn of $30k and $15k in revenue, so we needed $15k per month to stay afloat. So what would it have meant to have $100k paid in steps? Did it mean that I’d have to go see this guy every couple of weeks begging for an extra $10k? That wouldn’t seem like the best usage of a passionate entrepreneur’s time now would it?

And then there is the notion of payment being tied to pre-defined goals. As a startup navigates uncharted waters, your goals may change, you may find that your hypotheses were mistaken and that you need to pivot. You cannot pre-define goals a startup should attain any more than you can pre-define how you are going to bet at a poker table: you need to wait to see the cards.

Such terms are unacceptable, and, once more, I wish I were able to say that I turned them down right away. In fact I went on to meet with that person before walking away. Be smarter and save yourself an hour: politely say “thanks but no thanks”.

4. The 50% Discount People

And now we get to the pinnacle, the most ridiculously damaging terms I’ve been offered. The 50% Discount People (a loose group of business angels), who offered:

Steps 1 was fine. The valuation was slightly lower than what we had in mind but it was a single investor who would have covered our entire round, so it would have been less of a headache for us.

Their option to increase their participation at a predefined valuation was a slight risk: what if our business boomed and €2m ended up being too low? But the end of 2016 was a couple of months away so it wasn’t ludicrous either.

The critical point was their (never before voiced) request for a 50% discount in a second round. Think about that for a minute: they were asking to be able to buy shares in a second round for half the price that we were selling them—meaning at half the valuation. So if we needed a €2m round to reach our next milestone, they could walk in and say “ok we’ll take it all. Here is your €1m”. But that’s half of what we’d need! So we’d end up either being underfunded, having to issue more shares, or doing yet another round.

We would have ended in a situation where we’d be praying that our previous investors didn’t participate in a further round, or we would have had to find ways to work around that clause, for instance by raising a tiny second round to void it. None of these make any sense: a startup and its investors should have their interests aligned, and shouldn’t work against one another.

There, I did have enough wits to tell them to go fund themselves.

Wrapping up

These were a couple of personal experiences. I don’t claim they are representative of most of the investors or that they are worst terms ever. I know people who got worse ones, and companies who had to shut down as a consequence of their funding history.

My point is that not all of the money you can raise is created equal. Funding may come with strings attached, that may cause your ruin.

Why do investors do that? Hanlon’s razor states that you shouldn’t attribute to malice that which can be explained by stupidity. In most cases I believe that bad investors are ignorant rather than ill intentioned: by offering bad terms, they are screwing themselves as much as the startups they fund, since anything that’s bad for a startup is also bad for its investors.

“Never attribute to malice that which is adequately explained by stupidity”

But founders: the important thing to remember is that, when you’re taking someone’s money, you’re getting in bed with them. There is no easy way to get rid of them afterwards. So even though you may badly need the money, even though refusing funding may look stupid, think twice before accepting terms that may come back to haunt you.

1 I don't go in-depth in the different types of investors and rounds here ; if you are interested in the topic, Paul Graham’s excellent article about startup funding may be a good starting point. Also, depending on the legislation, there may be some extra constraints for business angels such as the requirement to be an accredited investor in the US.