If Amazon were IKEA, Netflix would be a meatball shop

All of Netflix’s business is for Amazon a mere customer acquisition channel

Aaah, IKEA’s meatballs. Who doesn’t love them? Tender, flavorful, perfectly complemented by the tangy cranberry jam… and, of course, oh so cheap: $5.99 in the US. That barely gets you a Pumpkin Spice Latte!

$6 is a steal. Raising that by 10%, 20%, perhaps even 30% would probably not reduce their sales significantly; it would be pure additional profit. So one can wonder: why don’t they charge more?

They don’t for the simple reason that IKEA understands their core business very well, and that is to sell furniture. They are the best in their segment, with better value, better distribution, and arguably better design. That’s what makes IKEA the world’s largest furniture retailer.

They also understand that their furniture sales will increase if they can remove as much friction as possible from the shopping. Cheap food, along with daycare, easy returns, delivery, and so on, each make the experience slightly easier and more enjoyable. In short, meatballs are a great complement to IKEA’s furniture, and as Joel Spolsky noted in one of his strategy letters:

“All else being equal, demand for a product increases when the prices of its complements decrease.”

IKEA throws in all of these complements at cost, so that you will come a little bit more often to their stores, spend a little bit longer there, and purchase more furniture. The same is true for Costco’s $1.50 hot dog and soda, if you don’t like meatballs.

Your main and your side business

Now think about Amazon and Netflix. Both are internet juggernauts. Both built pipelines of content right up to their customers’ doorstep. Amazon lets you have more or less anything at all, anywhere, including premium entertainment through Prime Video. Netflix lets you get any premium entertainment wherever you are (well, some of it, at least. We’ll get back to that.)

With these similarities, it would be fair to assume that their business models are similar: we sell you stuff and get a margin on it. It would also be dead wrong.

Streaming subscriptions make up 100% of Netflix’s $11.7b revenue. On that, they make $840m profit. That’s a 7% operating margin: not bad.

Amazon doesn’t report detailed numbers on Prime, but they claim more than 100 million subscribers, paying $12.99 per month, which would mean a revenue of a little less than $16b. However, Amazon has the same costs as Netflix¹, including massive production of original content, and on top of that needs to cover the logistics of two-day delivery for packages. It is therefore likely that Amazon makes no direct profit from Prime — and it fact it doesn’t need to.

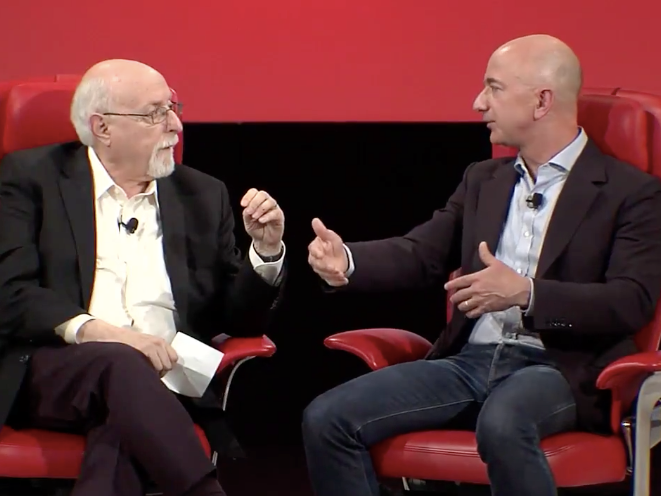

This is where any similarity between Netflix and Amazon break down: Amazon doesn’t need to make money out of what constitutes Netflix’s entire business. For Amazon, Prime and Prime Video are mainly channels to get their user hooked to their retail business. They are to Amazon’s main business what meatballs are to IKEA’s. As Jeff Bezos said:

“We get to monetize [our subscription video] in a very unusual way. When we win a Golden Globe, it helps us sell more shoes. And it does that in a very direct way.”

And the same holds true for many of Amazon’s other emblematic products: Dash buttons, Alexa, the Amazon Go stores: neither is a profit-making venture. They are tools which allow Amazon’s customers to never be more than a click away from their products.

So now you may think that retail is Amazon’s main business. After all, they made some $160b² last year selling stuff, so that must be what they are all about, right? Well wrong, again. See, most of the stuff Amazon sells can be found elsewhere too. If your pack of Tide pods were 10% more expensive on Amazon, would you stick around? No way. This is, once more, something Bezos understands, saying:

“customers are loyal to us right up until the second somebody offers them a better service.” Jeff Bezos, reported by Fast Company

With this comes the fact that they can’t make any meaningful profit off of retail. If your product is undifferentiated from that of your competitors, prices will be driven down until they just cover costs (that’s Bertrand competition for you. Check it out.) There’s no way for Amazon to get rich by selling soap and books: if they price them at a point where they make a significant margin, someone else will undercut them and they will lose customers.

Amazon’s main business(es)

What drives profit for Amazon is different stuff, most of which is not so visible to the casual observer.

First of all is Amazon Web Services, Amazon’s cloud hosting service. In 2017, AWS generated $17b in revenue and $4b of income. That’s a 25% margin — try doing the same by selling batteries. One of AWS’s customers is a video streaming company you may have heard about: Netflix.

Less known is Amazon’s advertising offering. Since 2016, Amazon has been the first place people make product searches, before Google. This makes Amazon’s homepage a most valuable advertising real estate for consumer goods companies, who are expected to shell out $4.5b for the privilege of being featured there in 2018. Amazon’s advertising numbers are bundled with the rest of their revenue so it’s hard to get a margin figure, but it’s probably substantially higher than that of instant ramen.

Amazon is also fulfilling orders for third party sellers, who can host their store within the yellow giant. In 2014, there were 2 million sellers on Amazon, paying $39.99 per month for the privilege of being there. That’s a billion dollars right there — and that’s with 4-year old data. Again, the margins are not reported but should be massive.

Only considering these three revenue streams, we have a $22.5b revenue and probably at least $7b profit.

But the key thing to understand is that, even if retail is not generating income, none of these highly profitable activities could exist without it. AWS was built by leveraging Amazon’s existing infrastructure. Advertising is possible only because people turn to Amazon when want to buy stuff. The same is true for third party sellers, for Amazon’s copious offering of financial services, and certainly other even-less-intuitive revenue streams I don’t know about.

Amazon leverages its position as number one in retail to operate these profitable ventures, and throws in lots of perks to make you more likely to keep shopping with them. Amazon has Prime even though it doesn’t make them any money the same way IKEA has meatballs: because they make the experience of shopping there a little bit more enjoyable and because they keep the brand a little bit more present in your mind. Netflix has video streaming the same way a meatball restaurant has meatballs: because it’s the only thing making them money.

Netflix’s history

Why this is so is in part explained by Netflix’s history. As per the company’s Wikipedia article:

[Marc] Randolph admired the fledgling e-commerce company Amazon and wanted to find a large category of portable items to sell over the Internet using a similar model.

That was 1997, when the Spice Girls were singing Wannabe and Amazon was still a bookstore. The Netflix guys saw potential in Amazon and copied what it was on the surface, settling for DVDs as the category they will distribute instead of Amazon’s books.

Did Jeff Bezos already have, at the time, a master plan of where Amazon would go (and make money) beyond books? Or did he simply have a better intuition? I doubt we will ever know, but it’s safe to assume that the guy or gal who comes up with an idea will have better chances of building on it than the folks who copy the visible part of it. Be that as it may, Netflix still sells video, while Amazon makes money from web hosting on the infrastructure of a shop made famous by their winning Golden Globes. Roughly.

If Jesus were a stock…

I’m painting a bleak image of Netflix, which is at odds with their market performance. Netflix’s stock grew by a factor 14 in the last 5 years. It has been lauded by many. Scott Galloway called it “The operating system for the second most important screen in our lives”.

Investing in Netflix hasn’t been a bad decision, historically

But to justify its current valuation, Netflix needs to keep growing massively in the upcoming decade, a fact that has been pointed out by others. The Economist reports an analyst saying:

“If Jesus were a stock, he’d be Netflix, you either believe or you don’t.”

There are reasons not to. As with Amazon, Netflix’s users are not loyal: the second some other service offers better content or at a better price, they will leave. Critically, while Amazon can claim to have all of the books and all of the stuff in many other categories, Netflix never had nor will have all of the entertainment. Stranger Things was great, sure, but I also watch Game of Thrones which is on HBO, and The Man in the High Castle by Amazon looks pretty great too. Will I subscribe to all three? Hell no! I will — and many others too I suspect — choose the one that offers most bang for the buck. For me that’s Netflix right now, but competition is intense.

Amazon is already in the game, producing billions of dollars worth of original content and doing it not as a main business but as a channel to more profitable ventures. That, plus the fact that Prime comes in with other perks, is sure to lure users away. In 2019, Disney will pull its content from Netflix and join the fray. With its acquisition of 20th Century Fox, Disney is responsible for 48.8% of all 2018 box office revenue so far. When people realize that Disney’s streaming service is the only place to see Marvel movies, the next Star Wars, or — God help us — the 4 sequels to Avatar, I suspect many will jump ship.

Because of this fragility, and because of all of the other revenue streams Amazon can tap, my money is on Bezos’ firm. And to go back to my first analogy: the IKEA next to my town opened 39 years ago. The restaurant next to my place changed hands 3 times in the past 3 years.

¹ One could make the argument that Amazon has lower hosting costs than Netflix since they use their own infrastructure whereas Netflix uses… Amazon. However that infrastructure is not free, and that capacity could be sold to another customer if Prime Video weren’t there. But AWS does generate massive economies of scale for Amazon.

² Amazon’s SEC filings bundle retail with Prime and many other activities, so it is difficult to get precise figures for anything other than AWS, which is reported separately